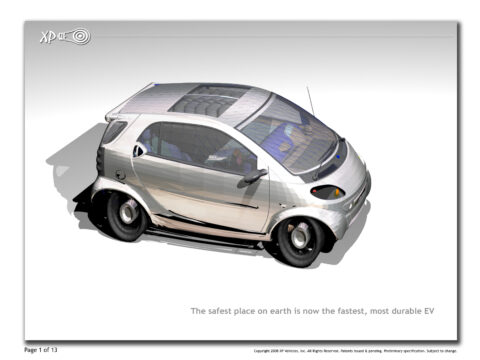

The XP Vehicle Platform Architecture:

The U.S. Patent Office, government contracts, NDA’s, federal records and emails show that we were the inventor of XP Vehicles design and architecture for long-range, low-weight, high-torque electric vehicles. XP Vehicles is an integrated technology platform of, both, proprietary and open-source vehicle creation assets. Federal Court hearing records and federal documents prove that our team were first in the design, build and deployment. All of our technologies and designs are on government record as “First-To-File” with Congress, The Patent Office, State Records, Department of Energy Filings, National Archives and other repositories.

Our team advocated for systems architecture throughout the auto industry that how now gained traction; the performance and dynamic metrics of which have beat every single other competing solution.

FUEL CELLS AND ENERGY STORAGE INVENTIONS AND PROJECT MANAGEMENT GALLERY

Every year since 2000 our research group has checked in with consumer car owners and auto industry suppliers. The bottom line has always been that no consumer electric car market will EVER happen until every consumer can charge their car at their home garage or home apartment parking spot. NOBODY, in any significant numbers, is going to drive many miles to a charging station, wait in line to get to the charger and then wait more than 4 minutes for their car to charge. The current time to charge most electric cars is 40 minutes with all of the fussing around accounted for.

We proposed a hot-swap battery system that any consumer can use, without driving to some special location. A consumer can hot-swap a wheeled battery in less than two minutes.

Senators and government officials don’t like that because they bought stock market investments in the ways that don’t work. Those White House and Department of Energy officials get bribes and stock market payola from Proterra, Ener1, Tesla and the old school suppliers, so they will not allow non-lithium-ion batteries and they will not allow fuel cell and ultra-capacitors to exist. Those politicians will not allow the only solutions that work to get to market. Here is what we told the Department of Energy and the White House, in writing for the last decade:

The United States has about 100,000 public chargers, far fewer than Europe and China. It needs 10 times as many, auto experts say, to complete the switch from combustion engine vehicles.

Over the past year, the electric vehicle charging industry has been swept up in a Wall Street gold rush because of growing optimism about electric cars and trucks.

In President Biden’s vision of a green future, half of all new cars sold in 2030 will be electric. But something really basic is standing in the way of that plan: enough outlets to plug in all those cars and trucks.

The country has tens of thousands of public charging stations — the electric car equivalent of gas pumps — with about 110,000 chargers. But energy and auto experts say that number needs to be at least five to 10 times as big to achieve the president’s goal. Building that many will cost tens of billions of dollars, far more than the $7.5 billion that lawmakers have set aside in the infrastructure bill.

Private investors are pouring hundreds of millions of dollars into building chargers, but the business suffers from a chicken-and-egg problem: Sales of electric cars are not growing fast enough to make charging profitable. It could be years before most charging companies break even, let alone mint big profits like Exxon Mobil and Chevron.

Fast chargers — ones that can fill up an electric car battery in 20 to 40 minutes — cost tens of thousands of dollars but are typically used less than humdrum gas pumps. Yet the auto and energy industries need to build them to reassure people that they won’t be stranded in an electric car with no plug in sight.

“E.V. charging infrastructure is the single biggest barrier to E.V. adoption,” said Asad Hussain, a senior analyst at PitchBook, a research firm. “You talk to anyone who’s on the fence about buying an E.V. and the No. 1 concern that comes to mind is range anxiety.”

The European Union, which is further along in electrifying cars, had nearly 200,000 public charging points last year. China, where electric cars are even more common than in Europe, had more than 800,000 in 2020.

European and Chinese officials have offered better incentives and imposed tougher regulations in part because they want to win a global race to build the cars and trucks of the future. U.S. policies, including the infrastructure bill, have been more modest because most Republicans and some Democrats oppose the regulation and spending needed to quickly ditch fossil fuels.

Soon, even $7.5 billion won’t be enough to lay the groundwork for the electric age, Nick Nigro, founder of Atlas Public Policy, a consulting and research firm based in Washington, said about the proposed federal spending on charging stations.

“Is it sufficient? No,” he said. “But it gets things going.”

Most drivers today plug in their electric cars at home, and only occasionally use public charging stations. But those stations will be crucial, especially to those who live in apartments and people who drive long distances.

For years, start-ups, automakers and other companies have been slowly building chargers, mainly in California and other coastal states where most electric cars are sold. These businesses use different strategies to make money, and auto experts say it is not clear which will succeed. The company with the most stations, ChargePoint, sells chargers to individuals, workplaces, stores, condo and apartment buildings, and businesses with fleets of electric vehicles. It collects subscription fees for software that manages the chargers. Tesla offers charging mainly to get people to buy its cars. And others make money by selling electricity to drivers.

Once the poor cousin to the hip business of making sleek electric cars, the charging industry has been swept up in its own gold rush. Venture capital firms poured nearly $1 billion into charging companies last year, more than the five previous years combined, according to PitchBook. So far in 2021, venture capital investments are up to more than $550 million.

On Wall Street, publicly traded special purpose acquisition companies, or SPACs, have struck deals to buy eight charging companies out of 26 deals involving electric vehicle and related businesses, according to Dealogic, a research firm. The deals typically include an infusion of hundreds of millions of dollars from big investors like BlackRock.

“It’s early, and folks are trying to wrap their heads around what does the potential look like,” said Gabe Daoud Jr., a managing director and analyst at Cowen, an investment bank.

These businesses could benefit from the infrastructure bill, but it is not clear how the Biden administration would distribute money for charging stations.

Another unanswered question is who will be the Exxon Mobil of the electric car age. It might well be automakers.

Tesla, which makes about two-thirds of the electric cars sold in the United States, has built thousands of chargers, which it made free for early customers. The company could open its network to vehicles made by other automakers by the end of the year, its chief executive, Elon Musk, said in July.

Volkswagen also owns a charging network, Electrify America, which is already available to all makes of cars. In Europe, Volkswagen, BMW, Ford Motor, Daimler and other automakers jointly own a charging company called Ionity. Drivers pay fees to charge in both cases, but some automakers offer free charging for a few years to entice car buyers.

Energy giants like BP and Royal Dutch Shell have gotten into the business, too, by buying charging companies in Europe and the United States.

And 14 electric utilities from Maine to Texas have formed the Electric Highway Coalition to build stations at intervals of 100 miles or less. Utilities elsewhere are also building chargers, as are cities like Los Angeles and New York.

They are all competing in a tiny market: Less than 4 percent of new car sales and less than 1 percent of vehicles on U.S. roads are electric.

Charging companies claim they can succeed even if it takes years for electric vehicles to take over. Some businesses like ChargePoint have been around for more than a decade, while others raising money don’t have much of a track record.

The chief executive of ChargePoint, Pasquale Romano, says his company avoids some costs by using contract manufacturers to build equipment and selling stations to employers who own electric vehicle fleets, retailers and others, who also buy software and maintenance subscriptions.

“Everyone thinks this can go fast, and it can’t,” Mr. Romano said. “You have to get in and start pedaling to help shape what it looks like.”

Volta, a smaller charging company, places chargers near the entrances of retailers like Whole Foods Market and Walgreens. The chargers show ads, generating revenue, and the stations pay for themselves within a few years, said the company’s president and a co-founder, Chris Wendel. “It’s a sponsored service brought to you by brands that care about what you’re doing.”

But some companies have stumbled. In December, TPG Pace Beneficial Finance, a SPAC backed partly by TPG, the private equity firm, announced that it would buy EVBox, an Amsterdam-based maker of charging equipment, valuing the company at $1.4 billion.

In January, Jim Cramer, the host of CNBC’s “Mad Money,” said EVBox was his favorite charging company because it is an established player in Europe. Shares of TPG Pace Beneficial climbed to $31 in February, from around $10.

But this month, the companies delayed the merger’s closing because EVBox has not yet released its audited financial statements for 2020. TPG Pace said in a regulatory filing that there was “significant uncertainty” about the deal’s completion, and its shares have fallen back to about $10.

A spokeswoman for EVBox declined to comment.

Mr. Cramer no longer stands by the EVBox pick. “I suppose we put too much faith in the financials as presented to investors at the time,” he said in an email.

Since the start of 2020, 16 proposed SPAC mergers have been canceled or withdrawn. And investors and regulators have raised questions about the optimistic claims made by executives and promoters of SPACs.

Yet investors continue to pour money into charging. One charging company, EVgo, completed a SPAC deal and started trading in July. Trading in Volta started last month. Several other deals have been announced in recent months, including for Tritium, which makes fast chargers; Wallbox, which sells charging equipment, software and related services; and Allego, which operates a large charging network in Europe.

Some investors think that charging cars might not be the best approach.

Last month, Ample, which aims to build stations where drained E.V. batteries are replaced with charged ones, raised $160 million. Raed Masri, founder of Transform VC, an investor in Ample, said battery swapping would be better for people without a place to plug in their cars because it is much faster.

“They need a quick energy delivery system, and only swapping provides that,” Mr. Masri said.

Other investors are making lots of bets. Energy Impact Partners, a private equity firm based in New York, has invested in several charging networks, a repair app for charging stations and an app that optimizes charging.

Cassie Bowe, a principal at the firm, said that with electric vehicle sales growing fast, it was urgent to build a network to support them. “There’s no more time,” she said. “We need this infrastructure fast.”

The reality is that the current plan can never work. There is not enough money, consumer interest, logistical embrace or other support for public chargers to ever be more than a feel good fancy. The consumer desire for speed-of-delivery increases over 10% per year. Nobody is going to put up with the wait, especially after sitting in rush-hour congestion every morning and night.

Electric cars will never happen in any volume unless every home and apartment has a charger, the rates for the chargers are less than gasoline and the batteries or energy cassettes can be instantly hot-swapped.

Let’s take a look at one option:

(Image credit: Hyperion)

The Hyperion XP-1 wants to show the world why hydrogen electric vehicles are the future. It boasts supreme performance, huge range, low weight and a futuristic design that’ll likely turn heads everywhere it goes.

It does away with the lithium-ion batteries you find in most electric cars available today, instead swapping them out for a hydrogen tank and super capacitors which not only weigh less, but can operate more efficiently at extreme temperatures and – Hyperion claims – the system is safer than lithium-ion counterparts.

We sat down with Hyperion CEO, Angelo Kafantaris, during CES 2021 to talk about the firm’s hydrogen ambitions and it’s new XP-1 hypercar.

If you want to know about the Hyperion XP-1, then read on as we have all the details on the futuristic car which uses some of the same technology as NASA.

(Image credit: Hyperion)

(Image credit: Hyperion)

Hyperion XP-1 release date and cost

Hyperion expects to begin production of the XP-1 in 2022, with the first customers receiving their vehicles by the end of that year, but the majority of orders are set to be fulfilled in 2023.

Just 300 Hyperion XP-1 hypercars are being produced and, while the firm has not revealed how much it costs, we expect that the price will be lofty.

Hyperion XP-1 speed, acceleration and range

HYPERION XP-1 SPECS

(Image credit: Hyperion)

(Image credit: Hyperion)

Engine: Hydrogen Electric

Power: 1500+ hp

0-62mph: under 2.2 seconds

Top speed: 221mph

Range: 1000 miles

Refill: under 5 minutes

Weight: 1032kg

Price: TBC

The Hyperion XP-1 has an impressive spec sheet. The four-wheel drive car can produce over 1500 hp, which the company claims will propel the XP-1 to a top speed of 221mph, making it faster than many big names including the Lamborghini Aventador S, McLaren Senna, Ferrari LaFerrari and Porsche 911 GT2 RS.

It will also be able to go from 0-60mph in lightning quick time – under 2.2 seconds. That puts the Hyperion XP-1 up there with some of the fastest accelerating cars on the planet.

Tesla’s Model S with Ludicrous Mode has a claimed time of 2.3 seconds, as does the Dodge Challenger SRT Demon and Ariel Atom 500 (V8), meanwhile the Bugatti Chrion comes in at 2.4 seconds and the Porsche 918 Spyder at 2.5 seconds.

Hyperion says that the XP-1 will be able to offer up to 1,000 miles of range from a single tank of hydrogen when driven at road legal speeds. That’s much greater than any current electric car available currently, with many ranging from 100 to 400 miles on a single top-up.

Once the hydrogen tank is empty, you can top it back up in under five minutes – far quicker than recharging the lithium-ion batteries in fully electric cars. The trouble is, there are hardly any hydrogen fueling stations around the world, which means owning a hydrogen-electric car right now isn’t overly practical.

Hyperion hopes the fueling network will develop in the coming years, and the driving force for it building the XP-1 is to help push forward its own plans to build a network of hydrogen fueling stations. It’s an energy company first, motor vehicle brand second.

It all sounds very impressive, but we’ll have to wait for the production cars to roll off the factory lines and arrive with owners before we can tell if the XP-1 can live up to the billing.

Image 1 of 5

(Image credit: Hyperion)

(Image credit: Hyperion)

(Image credit: Hyperion)

(Image credit: Hyperion)

(Image credit: Hyperion)

Hyperion XP-1 tech and solar spoilers

Part of the Hyperion XP-1’s unique design is its articulating, solar panel-clad rear wing. It swoops down over the side of the vehicle, hugging it.

The rear wing and raises up and moves backwards for optimum down force when driving, and when parked, the wing can track the sun’s movement and adjust its position to ensure it’s getting the most rays on its solar panels.

While the solar panels do not produce enough electricity to power the car, they do provide power for some of the electronics inside the vehicle – which takes a small amount of demand off the hydrogen.

Another eye-catching element of the Hyperion XP-1 can be found inside the cockpit and it stretches from the dash, through the middle of the two seats to the rear of the cabin.

(Image credit: Hyperion)

(Image credit: Hyperion)

We’re talking about its display. Instead of opting for a door-to-door screen like in the Honda E and Byton M-Byte, Hyperion has instead equipped the XP-1 with this unusual display between the seats.

Other than the image above, and knowing it will feature gesture controls, we don’t know too much else about the Tony Stark-inspired display. Kafantaris has confirmed that Hyperion will reveal more information about the display next month, and we’ll bring you everything you need to know when that happens.

The XP-1 is just the start for Hyperion in terms of vehicles, as Kafantaris explained.

“Future vehicles from Hyperion will always be in smaller numbers, but nothing quite as small as the 300 roll out we’re doing here.

“There will be cheaper vehicles, there will be more vehicles coming from Hyperion, but our focus will always be station infrastructure.”

It’s a company worth keeping an eye on then as the race between hydrogen electric and lithium ion in our cars really hots up.

Elon Musk makes his billions off of politically unstable lithium mining. Musk hates Fuel Cells and hydrogen because it obsoletes him:

AFGHAN LITHIUM SCAM_ countering_the_anti-hydrogen_trolls_and_shills_1-21 FUEL CELL.pdf

ATLIS also offers another option for the XP platform:

“PUT OUR TECHNOLOGY TO WORK FOR YOU

- RV manufacturers looking to enter the electric revolution

- Step van manufacturers looking for a 100% electric platform

- Box truck manufacturers looking to electrify their fleets

- Aftermarket vehicle builders looking to electrify a classic vehicle

- Innovative entrepreneurs looking to build a new generation of automotive vehicles

Green hydrogen has been in the news often lately. President-elect Biden has promised to use renewable energy to produce green hydrogen that costs less than natural gas. The Department of Energy is putting up to $100 million into the research and development of hydrogen and fuel cells. The European Union will invest $430 billion in green hydrogen by 2030 to help achieve the goals of its Green Deal. And Chile, Japan, Germany, Saudi Arabia, and Australia are all making major investments into green hydrogen.So, what is green hydrogen? Simply put, it is hydrogen fuel that is created using renewable energy instead of fossil fuels. It has the potential to provide clean power for manufacturing, transportation, and more—and its only byproduct is water.Where does green hydrogen come from?Hydrogen energy is very versatile, as it can be used in gas or liquid form, be converted into electricity or fuel, and there are many ways of producing it. Approximately 70 million metric tons of hydrogen are already produced globally every year for use in oil refining, ammonia production, steel manufacturing, chemical and fertilizer production, food processing, metallurgy, and more.There is more hydrogen in the universe than any other element—it’s been estimated that approximately 90 percent of all atoms are hydrogen. But hydrogen atoms do not exist in nature by themselves. To produce hydrogen, its atoms need to be decoupled from other elements with which they occur— in water, plants or fossil fuels. How this decoupling is done determines hydrogen energy‘s sustainability.Most of the hydrogen currently in use is produced through a process called steam methane reforming, which uses a catalyst to react methane and high temperature steam, resulting in hydrogen, carbon monoxide and a small amount of carbon dioxide. In a subsequent process, the carbon monoxide, steam and a catalyst react to produce more hydrogen and carbon dioxide. Finally the carbon dioxide and impurities are removed, leaving pure hydrogen. Other fossil fuels, such as ethanol, propane, gasoline, and coal can also be used in steam reforming to produce hydrogen. This method of production—powered by fossil fuels—results in gray hydrogen as well as 830 million metric tons of CO2 emissions each year, equal to the emissions of the United Kingdom and Indonesia combined.When the CO2 produced from the steam methane reforming process is captured and stored elsewhere, the hydrogen produced is called blue hydrogen.Hydrogen can also be produced through the electrolysis of water, leaving nothing but oxygen as a byproduct. Electrolysis employs an electric current to split water into hydrogen and oxygen in an electrolyzer. If the electricity is produced by renewable power, such as solar or wind, the resulting pollutant-free hydrogen is called green hydrogen. The rapidly declining cost of renewable energy is one reason for the growing interest in green hydrogen.Why green hydrogen is neededMost experts agree that green hydrogen will be essential to meeting the goals of the Paris Agreement, since there are certain portions of the economy whose emissions are difficult to eliminate. In the U.S., the top three sources of climate-warming emissions come from transportation, electricity generation and industry.Energy efficiency, renewable power, and direct electrification can reduce emissions from electricity production and a portion of transportation; but the last 15 percent or so of the economy, comprising aviation, shipping, long-distance trucking and concrete and steel manufacturing, is difficult to decarbonize because these sectors require high energy density fuel or intense heat. Green hydrogen could meet these needs.Advantages of green hydrogenHydrogen is abundant and its supply is virtually limitless. It can be used where it is produced or transported elsewhere. Unlike batteries that are unable to store large quantities of electricity for extended periods of time, hydrogen can be produced from excess renewable energy and stored in large amounts for a long time. Pound for pound, hydrogen contains almost three times as much energy as fossil fuels, so less of it is needed to do any work. And a particular advantage of green hydrogen is that it can be produced wherever there is water and electricity to generate more electricity or heat.Hydrogen has many uses. Green hydrogen can be used in industry and can be stored in existing gas pipelines to power household appliances. It can transport renewable energy when converted into a carrier such as ammonia, a zero-carbon fuel for shipping, for example.Hydrogen can also be used with fuel cells to power anything that uses electricity, such as electric vehicles and electronic devices. And unlike batteries, hydrogen fuel cells don’t need to be recharged and won’t run down, so long as they have hydrogen fuel.Fuel cells work like batteries: hydrogen is fed to the anode, oxygen is fed to the cathode; they are separated by a catalyst and an electrolyte membrane that only allows positively charged protons through to the cathode. The catalyst splits off the hydrogen’s negatively charged electrons, allowing the positively charged protons to pass through the electrolyte to the cathode. The electrons, meanwhile, travel via an external circuit—creating electricity that can be put to work—to meet the protons at the cathode, where they react with the oxygen to form water.Hydrogen is used to power hydrogen fuel cell vehicles. Because of its energy efficiency, a hydrogen fuel cell is two to three times more efficient than an internal combustion engine fueled by gas. And a fuel cell electric vehicle’s refueling time averages less than four minutes.Because they can function independently from the grid, fuel cells can be used in the military field or in disaster zones and work as independent generators of electricity or heat. When fixed in place they can be connected to the grid to generate consistent reliable power.The various obstacles green hydrogen faces can actually be reduced to just one: cost. Julio Friedmann, senior research scholar at Columbia University’s Center on Global Energy Policy, believes the only real challenge of green hydrogen is its price. The fact that 70 million tons of hydrogen are produced every year and that it is shipped in pipelines around the U.S. shows that the technical issues of distributing and using hydrogen are “straightforward, and reasonably well understood,” he said.The problem is that green hydrogen currently costs three times as much as natural gas in the U.S. And producing green hydrogen is much more expensive than producing gray or blue hydrogen because electrolysis is expensive, although prices of electrolyzers are coming down as manufacturing scales up. Currently, gray hydrogen costs about €1.50 euros ($1.84 USD) per kilogram, blue costs €2 to €3 per kilogram, and green costs €3.50 to €6 per kilogram, according to a recent study.Friedmann detailed three strategies that are key to bringing down the price of green hydrogen so that more people will buy it:

- Support for innovation into novel hydrogen production and use. He noted that the stimulus bill Congress just passed providing this support will help cut the cost of fuel cells and green hydrogen production in years to come.

- Price supports for hydrogen, such as an investment tax credit or production tax credit similar to those established for wind and solar that helped drive their prices down.

- A regulatory standard to limit emissions. For example, half the ammonia used today goes into fertilizer production. “If we said, ‘we have an emission standard for low carbon ammonia,” then people would start using low carbon hydrogen to make ammonia, which they’re not today, because it costs more,” said Friedmann. “But if you have a regulation that says you have to, then it makes it easier to do.” Another regulatory option is that the government could decide to procure green hydrogen and require all military fuels to be made with a certain percentage of green hydrogen.

Green hydrogen’s futureA McKinsey study estimated that by 2030, the U.S. hydrogen economy could generate $140 billion and support 700,000 jobs.Friedmann believes there will be substantial use of green hydrogen over the next five to ten years, especially in Europe and Japan. However, he thinks the limits of the existing infrastructure will be reached very quickly—both pipeline infrastructure as well as transmission lines, because making green hydrogen will require about 300 percent more electricity capacity than we now have. “We will hit limits of manufacturing of electrolyzers, of electricity infrastructure, of ports’ ability to make and ship the stuff, of the speed at which we could retrofit industries,” he said. “We don’t have the human capital, and we don’t have the infrastructure. It’ll take a while to do these things.”Many experts predict it will be 10 years before we see widespread green hydrogen adoption; Friedmann, however, maintains that this 10-year projection is based on a number of assumptions. “It’s premised on mass manufacturing of electrolyzers, which has not happened anywhere in the world,” he said. “It’s premised on a bunch of policy changes that have not been made that would support the markets. It’s premised on a set of infrastructure changes that are driven by those markets.”There are a number of green energy projects in the U.S. and around the world attempting to address these challenges and promote hydrogen adoption. Here are a few examples.California will invest $230 million on hydrogen projects before 2023; and the world’s largest green hydrogen project is being built in Lancaster, CA by energy company SGH2. This innovative plant will use waste gasification, combusting 42,000 tons of recycled paper waste annually to produce green hydrogen. Because it does not use electrolysis and renewable energy, its hydrogen will be cost-competitive with gray hydrogen.A new Western States Hydrogen Alliance, made up of leaders in the heavy-duty hydrogen and fuel cell industry, are pushing to develop and deploy fuel cell technology and infrastructure in 13 western states.Hydrogen Europe Industry, a leading association promoting hydrogen, is developing a process to produce pure hydrogen from the gasification of biomass from crop and forest residue. Because biomass absorbs carbon dioxide from the atmosphere as it grows, the association maintains that it produces relatively few net carbon emissions.Breakthrough Energy, co-founded by Bill Gates, is investing in a new green hydrogen research and development venture called the European Green Hydrogen Acceleration Center. It aims to close the price gap between current fossil fuel technologies and green hydrogen. Breakthrough Energy has also invested in ZeroAvia, a company developing hydrogen-fueled aviation.In December, the U.N. launched the Green Hydrogen Catapult Initiative, bringing together seven of the biggest global green hydrogen project developers with the goal of cutting the cost of green hydrogen to below $2 per kilogram and increasing the production of green hydrogen 50-fold by 2027.Ultimately, whether or not green hydrogen fulfills its promise and potential depends on how much carmakers, fueling station developers, energy companies, and governments are willing to invest in it over the next number of years.But because doing nothing about global warming is not an option, green hydrogen has a great deal of potential, and Friedmann is optimistic about its future. “Green hydrogen is exciting,” he said. “It’s exciting because we can use it in every sector. It’s exciting because it tackles the hardest parts of the problem—industry and heavy transportation. It’s interesting, because the costs are coming down. And there’s lots of ways to make zero-carbon hydrogen, blue and green. We can even make negative carbon hydrogen with biohydrogen. Twenty years ago, we didn’t really have the technology or the wherewithal to do it. And now we do.”THE XP PLATFORM

CONFIGURABLE BATTERY4 INDEPENDENTTRACTION MOTORSINTELLIGENT INDEPENDENT STEERING AT EACH AXLEMODULAR SUBSYSTEM

CONFIGURABLE BATTERY4 INDEPENDENTTRACTION MOTORSINTELLIGENT INDEPENDENT STEERING AT EACH AXLEMODULAR SUBSYSTEM F

F